Difference Between Actual Cost and Standard Cost

Key Difference – Actual Cost vs Standard Cost

Actual cost and standard cost are two frequently used terms in management accounting. The key difference between actual cost and standard cost is that actual cost refers to the cost incurred or paid whereas standard cost is an estimated cost of a product considering the material, labor and overhead costs that should be incurred. Budgets are prepared at the beginning of the period with estimates for revenues and costs and the actual results will be recorded throughout the period. At the end of the period, the actual costs will be compared with the standard costs where variances will be identified.

CONTENTS

1. Overview and Key Difference

2. What is Actual Cost

3. What is Standard Cost

4. Side by Side Comparison – Actual Cost vs Standard Cost

5. Summary

What is Actual Cost?

As the name itself suggests, actual cost is the cost that is actually incurred or paid. Actual cost is realized and does not depend on an estimate. The management prepares budgets for a period of time with the intention of achieving the budget during the financial year. However, due to the unforeseen circumstances variations are bound to occur, making the actual results often different from the budgeted. A company having relatively stable production volumes from month to month will have few problems with actual costing.

What is Standard Cost?

Standard cost is a predetermined cost assigned for units of material, labor and other costs of production for a specific time period. At the end of this period, the actual cost incurred may be different to the standard cost, thus a ‘variance’ may arise. Standard Costing can be successfully used by companies with repetitive business operations, thus this approach is very suitable for manufacturing organizations.

Setting Standard Costs

Two commonly used approaches are used to set standard costs are,

- Using past historical records to estimate labor and material usage

Past information on costs can be used to provide a basis for present period costs

- Using engineering studies

This may involve a detailed study or observation of operations in terms of material, labor and equipment usage. The most effective control is achieved by identifying standards for quantities of material, labor and services to be used in an operation, rather than an overall total product cost.

Standard cost provides an informed basis for effective cost allocation and evaluation of production performance. Once standard costs are compared with actual costs and variances are identified, this information can be utilized to take corrective actions for negative variances and for future cost reduction and improvement purposes. Standard costing is a management accounting tool used in management decision-making to allow better cost control and optimal resource utilization. When there are variances between the standard and actual costs, the reasons for them should be researched, analyzed and remedies should be introduced by the management to ensure the variances are minimized in the next accounting period. Standard cost cannot be used to report results in year-end financial statements as both GAAP (Generally Accepted Accounting Principles) and IRFS (International Financial Reporting Standards) require companies to report actual incomes and expenses in financial statements. Thus, standard cost is only used for internal management decision making of the organization.

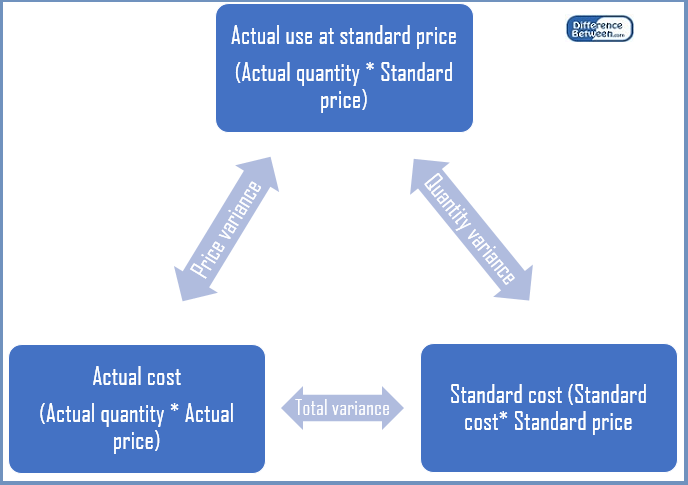

Analyzing actual costs and standard costs in isolation will not provide adequate results; both should be considered in amalgamation to generate useful information for decision making by the use of variance analysis. A variance is a difference between the standard cost and the actual cost. Variances can be calculated between incomes as well as expenses.

E.g. Sales variance calculates the difference between expected and actual sales

Direct material variance calculates the difference between expected direct material cost and the actual direct material cost.

There are two main types of variances to due to the difference between standards and actuals. They are,

Rate/Price Variance

Rate/price variance is the difference between the expected price and the actual price multiplied by the volume of activity.

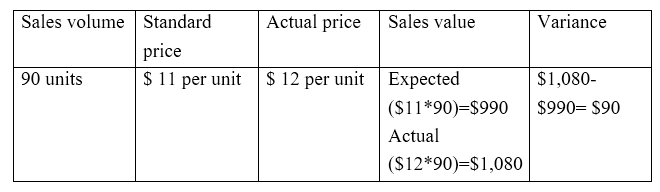

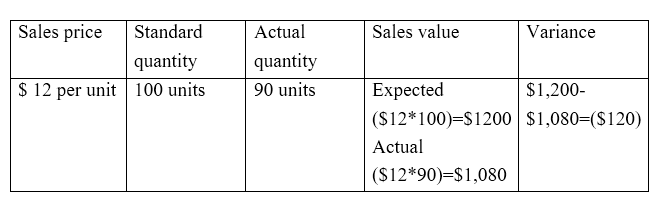

E.g. Sales price variance

Volume Variance

Volume variance is the difference between the expected quantity to be sold, and the actual quantity sold multiplied by the cost per unit.

E.g. Sales volume variance

Figure 01: Relationship between actual and standard cost

What is the difference between Actual Cost and Standard Cost?

Actual Cost vs Standard Cost | |

| Actual cost refers to the cost incurred or paid. | Standard cost is an estimated cost of a product considering the material, labor and overhead costs that should be incurred. |

| Use in Financial Statements | |

| Actual costs should be included in financial statements. | Using standard cost in financial statements is not allowed by accounting standards |

| Recording of the Costs | |

| Actual cost is recorded during the year while the company is conducting business. | Standard cost is recorded at the beginning of the accounting period while budget preparation. |

Summary- Actual cost vs standard cost

It is important to clearly understand the difference between actual cost and standard cost in order to understand many aspects of management accounting. The main difference between actual cost and standard cost is that actual cost refers to the cost incurred or paid whereas standard cost is an estimated cost of a product. Once a budget is prepared, there should be a control mechanism to evaluate how successfully the budget was achieved. Actual and standard cost enables such comparison.

References

1. “Actual Cost.” My Accounting Course. N.p., n.d. Web. 28 Mar. 2017.

2. “Standard Costing.” AccountingTools. N.p., n.d. Web. 29 Mar. 2017.

3. “Variance Analysis.” Variance Analysis | Formulas | Examples | Calculation | Importance. N.p., n.d. Web. 29 Mar. 2017.

4. Smith, Graydon. “Standard costing vs. actual costing.” RSM US Consulting Pros. N.p., 10 June 2016. Web. 29 Mar. 2017.

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26twq2smqRdmLy0wIyapZ1lpqh6tMDAp5uaqpRisLC%2F02g%3D