Difference Between Annuity and Compound Interest

Key Difference – Annuity vs Compound Interest

Investors use a number of investment opportunities in order to generate returns. Annuity and compound interest are two such options that can be considered by an investor depending on the investment requirements. The key difference between annuity and compound interest is that while annuity is an investment that offers a guaranteed income for a certain period of time as a result of a substantial sum paid up front; compound interest investment earns interest on a growing basis since each interest will be added to the original amount invested when subsequent interests are calculated.

CONTENTS

1. Overview and Key Difference

2. What is Annuity

3. What is Compound Interest

4. Side by Side Comparison – Annuity vs Compound Interest

5. Summary

What is Annuity

Annuity is an investment that periodic withdrawals are made from. In other words, this is an agreement between the investor and a third party (usually an investment company). To invest in annuity, an investor should have a large sum of money to be invested at once where withdrawals will be made over a period of time. In exchange for this sum of money, the insurance company promises to provide an income for a predetermined time period, or for life (will be determined based on the agreement). Retirement funds and mortgages are most commonly invested annuities.

There are two main types of annuities as described below.

Fixed Annuities

A guaranteed income is earned on these type of annuities where the income is not affected by changes in interest rates and market fluctuations; thus, they are the safest type of annuities. Given below are different types of fixed annuities.

Immediate Annuity

Investors receive payments soon after making the initial investment

Deferred Annuity

This accumulates money for a pre-determined time period before starting to make payments.

Multi-Year Guarantee Annuities (MYGAS)

It pays a fixed interest rate each year for a certain period of time.

Variable Annuities

The amount of income varies in this type of annuities since they give the opportunity for investors to generate higher rates of return by investing in equity or bond sub-accounts. Income will vary based on the performance of the sub account values. This is ideal for investors who wish to benefit from higher returns, but at the same time, they should be prepared to endure the probable risks. Variable annuities have higher fees due to the associated risk.

What is Compound interest

Compound interest is an investment method where interest received will continue to add up to the principal sum (original sum invested) and the following period’s interest is calculated not only based on the originally invested amount but based on the addition of principal and the interest earned.

E.g. Assuming that a $1,000 deposit is made on the 1st of January at a rate of 10% per month, the deposit receives an interest of $100 per month continuing for the year. However, for the deposit made on 1st of February at the same rate, the interest will be calculated not on $1,000, but on $1,100 (including the interest earned in January). The interest for February will be calculated for 11 months assuming that this is a one-year investment.

It is important for an investor to know what is the total sum that the investment will have at its maturity; this can be derived using the below formula.

FV= PV (1+r) n

Where,

FV= Future Value of the fund (at its maturity)

PV= Present Value (the amount that should be invested today)

r = Rate of return

n = Number of time periods

Continuing from the above example,

E.g. FV= $1,000 (1+0.1)12

= $3,450 (rounded to the nearest whole number)

This means that if a deposit of $1,000 is made on 1st of January, it will grow to $3,450 by the end of the year.

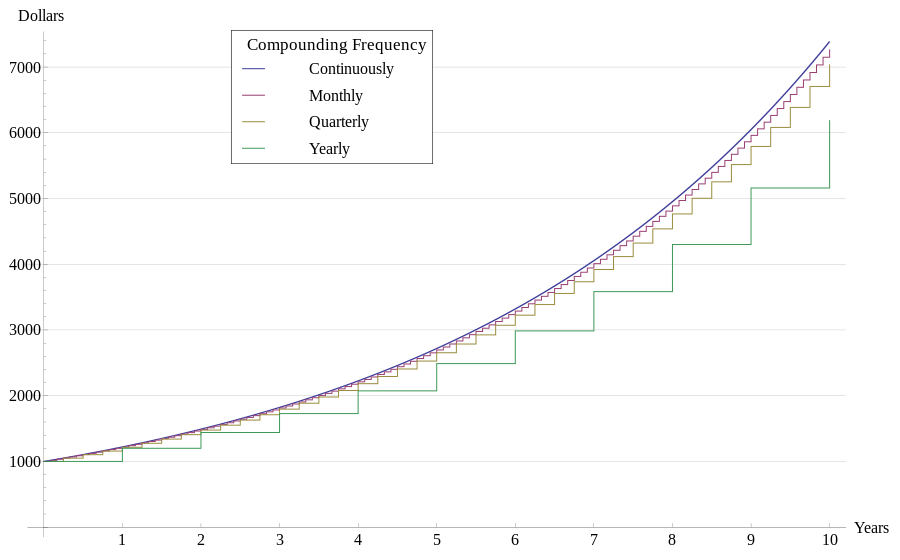

Figure 1: Compound interest can be calculated periodically

What is the difference between Annuity and Compound Interest?

Annuity vs Compound Interest | |

| Annuity is an investment from which periodic withdrawals are made. | Compound Interest earns interest on a growing basis since interest is earned on interest in addition to the original amount. |

| Initial Investment | |

| Annuity requires a large sum of money as the initial investment. | Investing can be done even from a small fund. |

| Growth in Interest | |

| Annuity investment can be increased by investing in equity and bond sub-accounts. | Compound Interest investment value grows even in the absence of additional investment since interest earned increases automatically. |

Summary – Annuity vs Compound Interest

The difference between annuity and compound interest is that unlike in annuity, compound interest does not require a lump sum of money at the beginning of the investment; thus, it is an attractive investment option for many investors. Investing in an annuity is usually done by a person closer to retirement in order to receive a guaranteed income during retirement. However, if the stock market conditions are not favourable, investments in variable annuities will generate more volatile returns.

Reference:

1. “What is an annuity?” Investopedia. N.p., n.d. Web. 24 Feb. 2017.

2. “Compound Interest vs. Annuity.” Budgeting Money. The Nest, 28 Apr. 2012. Web. 24 Feb. 2017.

3. “What is an annuity?” CNNMoney. Cable News Network, n.d. Web. 24 Feb. 2017.

4. Segal, Troy. “Compound Interest.” Investopedia. N.p., 12 Dec. 2016. Web. 24 Feb. 2017.

Image Courtesy:

1. “Compound Interest with Varying Frequencies” By Jelson25 – Own work (CC BY-SA 3.0) via Commons Wikimedia

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26tzaesoqypYq6vsIyvqmabn6K9sMHNnWSipqSav6a%2F02g%3D