Difference Between Capital Reserve and Reserve Capital

Capital Reserve vs Reserve Capital

People tend to confuse capital reserve and reserve capital as the same thing as they sound somewhat similar, but despite their seemingly similar sound, there is some difference between capital reserve and reserve capital. While capital reserves arise from capital profits, reserve capital is the share capital that is yet uncalled by the company from its shareholders. The article below offers a clear explanation of what capital reserve and reserve capital are, how they are accounted, and also highlights the differences between capital reserve and reserve capital.

What is Capital Reserve?

Capital reserves are reserves that arise out of capital profits and surpluses. These include profits that are gained from the revaluation of company assets, capital surpluses that arise from the business purchase, long-term capital gains that arise from asset transfers, etc. Since these reserves are created from capital profits, they are not available for distribution among company shareholders. Capital reserves of a firm can be used at any times for a number of purposes such as capital investment projects, future capital expenses or the purchase of company long term assets. Capital reserves can also be utilized in order to write off any capital losses that arise as a result of selling assets at prices lower than book value.

What is Reserve Capital?

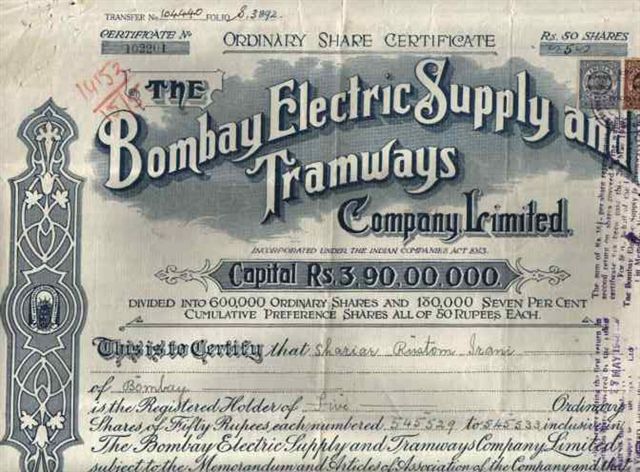

Reserve capital is the amount of share capital that the company has not yet called up from its total authorized capital. Authorized share capital is the total value of shares that a company can issue legally. Uncalled capital refers to the funds that are not yet paid up by shareholders for the shares that they purchased of the firm. It is possible for a firm to utilize its reserve capital in an emergency or in the case of liquidation.

What is the difference between Capital Reserve and Reserve Capital?

Though the two terms capital reserve and reserve capital sound quite similar to one another, there are a number of major differences between capital reserve and reserve capital. While both are forms of capital held by a firm, capital reserves arise from capital profits and capital surpluses, whereas reserve capital arises through the company’s uncalled share capital. Reserve capital can be utilized when required, but is generally used in the event that the company goes into liquidation. Capital reserves can be used at any time for a number of purposes. Capital reserves are recorded as a liability on the company balance sheet, whereas reserve capital is not recorded on the balance sheet.

Summary:

Capital Reserve vs Reserve Capital

• Capital reserve and reserve capital are both forms of capital held by a firm.

• Capital reserves arise from capital profits and capital surpluses of a firm, and therefore cannot be utilized to pay dividends to shareholders.

• Capital reserves of a firm can be used at any times for a number of purposes such as capital investment projects, for future capital expenses or the purchase of company long term assets.

• Reserve capital is the share capital that is not called up from its authorized capital. This capital can be called up and utilized in the case of an emergency, but is generally utilized in the event that the company goes into liquidation.

• Capital reserves are recorded as a liability on the company balance sheet, whereas reserve capital is not recorded on the balance sheet.

Photos By: BOMBMAN (CC BY 2.0)

Further Reading:

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26vwKmgrZmcYr%2Bmv8SrrZ5lkaOxbsLSZqmeq5Wnw6Z5wpqnoqyRoXw%3D