Difference Between Offer for Sale and Offer for Subscription

Key Difference – Offer for Sale vs Offer for Subscription

Offer for Sale and Offer for Subscription are two main ways of offering shares to the investors. Although the structure of the two methods is similar, there is a key difference between offer for sale and offer for subscription. In an offer for sale, the investors are invited to purchase new shares of a company; in an offer for subscription, a minimum level of subscription should materialize if the offer is to be successful (in case this criterion does not meet, the offer is withdrawn).

CONTENTS

1. Overview and Key Difference

2. What is an Offer for Sale

3. What is an Offer for Subscription

4. Side by Side Comparison – Offer for Sale vs Offer for Subscription

What is an Offer for Sale?

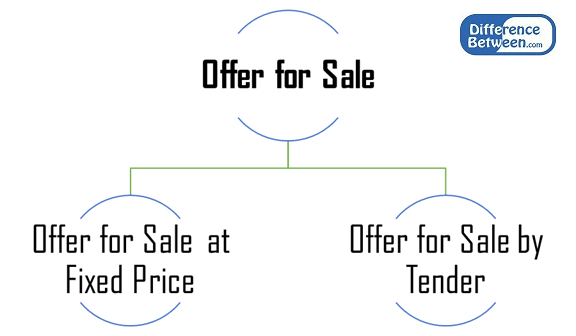

This refers to a company advertising new shares for sale to the public as a way of launching itself on the Stock Exchange. Offer for Sale is different from an initial public offering (IPO); IPO refers to the criteria of going public for the first time, but offer for sale is conducted by a company which is already listed on a stock exchange. There are two main ways that an Offer for Sale can be conducted.

Offer for Sale by Fixed Price

Here, sponsor fixes the price prior to the offer. This fixed price is usually set at a premium above the market price.

Offer for Sale by Tender

The tender process is an open offer or invitation to all stockholders of a publicly traded corporation to buy shares of a company. Investors state the price they are willing to pay, which is referred to as the ‘bidding’ process. A ‘strike price’ is established by the sponsors after receiving all the bids. Shareholders will also specify the minimum price (floor price) at which they intend to sell the shares. Thus, the strike price should always be higher than the ‘floor price’. An ‘indicative price’ will also be conducted which is the weighted average price of all the valid bids.

The prospective investor who wishes to bid for the offer should quote a higher price than the market price at which a share is tradable in order to make an attractive offer. Offering a higher bid is often characterised by an intention of acquiring a controlling stake in the respective company.

e.g. If a stock’s current price is $10/share, someone wishing to take over the company might issue a tender offer for $12/share on the condition that he can acquire at least 51% of the shares.

Conditions to Promote an Offer for Sale

Main conditions that should be met to promote an Offer for Sale include,

- Shareholders who intend to promote an offer for sale should at least hold 10% of share capital

- Shareholders should not have purchased and/or sold the shares of the company in the 12 weeks period prior to the offer

- Shareholders should not undertake to purchase and/or sell shares of the company in the 12 weeks period after the offer

Offer for Sale shares process is completed within a single trading day, therefore is less time-consuming. Furthermore, the amount of documentation needed are fairly less compared to a process such as an IPO; therefore, it is very transparent. In offer for sale, there is no restriction on a number of bids a single buyer can make.

What is an Offer for Subscription?

Offer for Subscription is similar to Offer for Sale but there is a minimum level of subscription for the shares; the offer is withdrawn in case that the minimum level is not reached. Just as with offer for sale, offer for subscription can also be made at a fixed price or at tender. Offer for subscription share issues has an expiration date.

What is the difference between Offer for Sale and Offer for Subscription?

Offer for Sale vs Offer for Subscription | |

| Offer for sale is “a situation in which a company advertises new shares for sale to the public as a way of launching itself on the Stock Exchange”. | Offer for subscription is similar to an offer for sale, but there is a minimum level of subscriptions for the shares; the offer is withdrawn if this is not met. |

| Requirement Criteria | |

| Advertising of an offer for investors to purchase the shares of the company is required. | If the offer is to be successful, a minimum offer value or a number of shares should be met. |

Risk | |

| Offer for sale is less risky since the success of the offer does not depend on achieving a pre-determined offer level. | If the offer is unsuccessful due to not being able to get sufficient number of investors to subscribe, it will be a waste of time and resources |

Offer for Sale and Offer for Subscription are not for everyone. These are riskier and highly volatile compared to ordinary shares, thereby these type of security acquisition is better suited for experienced investors.

Reference:

“About Offer For Sale.” BSE India. N.p., n.d. Web. 31 Jan. 2017.

“Pros and cons of subscription shares.” Monevator. N.p., 18 May 2011. Web. 31 Jan. 2017.

“What is fixed-price tender offer? definition and meaning.” BusinessDictionary.com. N.p., n.d. Web. 31 Jan. 2017.

“What is offer for sale? Definition and meaning.” InvestorGuide.com. N.p., n.d. Web. 31 Jan. 2017.

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau267xZ%2Bcq2WWpL9uv8ClnGaZnpl6t7%2BMqJ2fnaJis7C%2BjKysm6uTp7axwMiopWg%3D