Difference Between Residual Income and EVA

Key Difference – Residual Income vs EVA

Evaluating investment opportunities is important in order to realize the respective costs and benefits of each investment option. Residual Income and EVA (Economic Value Added) are two methods that assess how much funds in excess of the business’ cost of capital the investment is projected to generate. Both residual income and EVA are based on the same principle the difference lies in the way they are calculated. While Residual Income uses operating profit in its calculation, EVA uses the net operating profit after tax. This is the key difference between residual income and EVA.

CONTENTS

1. Overview and Key Difference

2. What is Residual Income

3. What is EVA

4. Side by Side Comparison – Residual Income vs EVA

5. Summary

What is Residual Income?

Residual income is a performance measure normally used to assess the performance of divisions, in which a finance charge is deducted from the profits. This finance charge represents the cost of capital in monetary terms (derived by multiplying the operating assets by the cost of capital). The net operating income is the difference between incomes generated by the investment minus the associated expenses.

Residual Income = Net Operating Profit – (Operating Assets* Cost of Capital)

- Net operating profit – A profit from business operations (gross profit less operating expenses) before deduction of interest and taxes.

- Operating assets – Assets used to generate revenue

- Cost of capital– Opportunity cost of making an investment.

Companies can acquire capital in the form of equity or debt; many companies are keen on a combination of both.

Cost of Equity

The rate of return to be provided for shareholders

Cost of Debt

The rate of return to be provided for debtholders

Weighted Average Cost of Capital (WACC)

WACC calculates an average cost of capital considering the weightages of both equity and debt components. This is the minimum rate that should be achieved in order to create shareholder value.

E.g. Division A made a profit of $20,000 during the most recent financial year. Company’s asset base was $90,000, comprising of both debt and equity. The weighted average cost of capital of the company is 13%, and this is used when calculating the finance charge.

Residual income = 20,000- (90,000*13%) = $8,300

The finance charge of $11,700 represents the minimum return required by the providers of finance on the $90,000 capital they provided. Since the actual profit of the division exceeds this, the division has recorded residual income of $8,300.

RI can provide insight into the rate of return on invested assets in different divisions.

E.g. Consider two operating divisions and their Residual Incomes as per below.

A B

Net operating profit $ 25,000 $ 25,000

Operating assets $ 10,000 $ 18,000

Cost of capital 10% 10%

Residual income $ 24000 $ 23,200

Even though the above two divisions make similar profits, the asset base of division B is significantly higher than division A, thus its residual income is lower. This is because more assets are required to produce a similar income to division A.

What is EVA?

EVA is also calculated using the cost of capital, assessing how much value the investment adds to the business. EVA projects what the company’s after-tax profit will be after subtracting the cost of capital in monetary terms from the projected net operating profit after taxes. Formula to calculate EVA is,

EVA = Net Operating Profit After Tax – (Operating Assets* Cost of Capital)

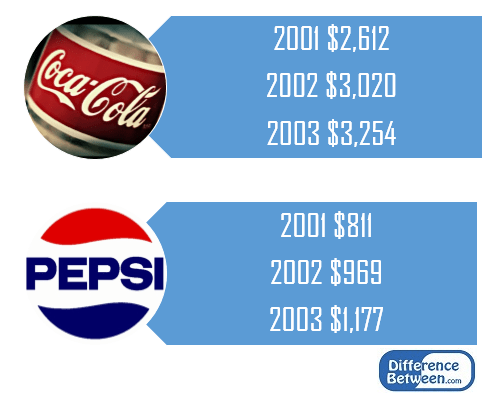

Economic Value Added is also referred to as EVA TM which is a trademark performance measurement developed by the US consulting firm Stern Stewart & Co; it has gained widespread use among many well-known companies such as Siemens, Coca-Cola, Pepsi and Herman Miller.

Figure_1: EVA for Coca-Cola and Pepsi from 2001-2003

What is the difference between Residual Income and EVA?

Residual Income vs EVA | |

| Residual income calculates the amount of asset utilization based on net operating profit | EVA calculates the amount of asset utilization based on net operating profit after tax. |

| Effectiveness | |

| Residual income is more effective compared to EVA. | EVA is less effective than Residual Income due to tax adjustments. |

| Formula for Calculation | |

| Residual Income = Net Operating Profit – (Operating Assets* Cost of Capital) | EVA = Net Operating Profit After Tax – (Operating Assets* Cost of Capital) |

Summary – Residual Income vs EVA

The only notable difference between residual income and EVA is resulting from tax payment since residual income is calculated on net operating profit before tax whereas EVA considers the profit after tax. The basis of these measures is to identify how effectively a company utilized its assets. Thus, tax, which is an uncontrollable expense that is not directly related to the use of assets, reduces the effectiveness of EVA as an investment decision tool. One of the main drawbacks in residual income and EVA is that they are absolute figures, which make it difficult to be used effectively for comparison purpose. A number of research studies has also found that there is no significant relationship between EVA and earnings per share.

Reference:

1. “Cost Of Capital.” Investopedia. N.p., 25 Mar. 2016. Web. 14 Feb. 2017.

2. “Residual Income (ri) Lesson.” Chegg. N.p., n.d. Web. 14 Feb. 2017.

3. “Residual Income Formula | Definition | Example.” My Accounting Course. N.p., n.d. Web. 14 Feb. 2017.

4. “What Is the Difference Between Economic Value Added & Residual Income” Chron.com. N.p., n.d. Web. 14 Feb. 2017.

5. “Coke Vs Pepsi 092506.” Share and Discover Knowledge on LinkedIn SlideShare. N.p., 20 Aug. 2009. Web. 14 Feb. 2017.

6. Abdoli, Mohamadreza, Mohamadreza Shurvarzi, and A. Farokhad.”Economic Value Added vs. Accounting Residual Income; Which One Is a Better Criterion for Measurement of Created Shareholders Value.” World Applied Sciences Journal 17.7 (2012): 874-881.

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau26%2BxKygna2RoXqqusKopJ5lkaOxbsLSZpyvmV8%3D