Difference Between W2 W4 and W9

Key Difference – W2 vs W4 vs W9

Since tax amounts to a major source of revenue to the government, it is important to ensure that sufficient amounts are deducted from each taxpayer. W2, W4, and W9 are three tax-related documents in the United States that must be filled by employers, employees and independent contractors, respectively. The key difference between W2 W4 and W9 are as follows. The W2 is the form sent by an employer to the employee and the Internal Revenue Service (IRS) at the end of each year. W4 is completed by the employee in order to indicate his or her tax situation to the employer. W9 is the form filled by third party companies such as independent contractors who provide services to companies, upon the request from the respective company.

CONTENTS

1. Overview and Key Difference

2. What is W2

3. What is W4

4. What is W9

5. Similarities between W2, W4 and W9

6. Side by Side Comparison – W2 vs W4 vs W9 in Tabular Form

7. Summary

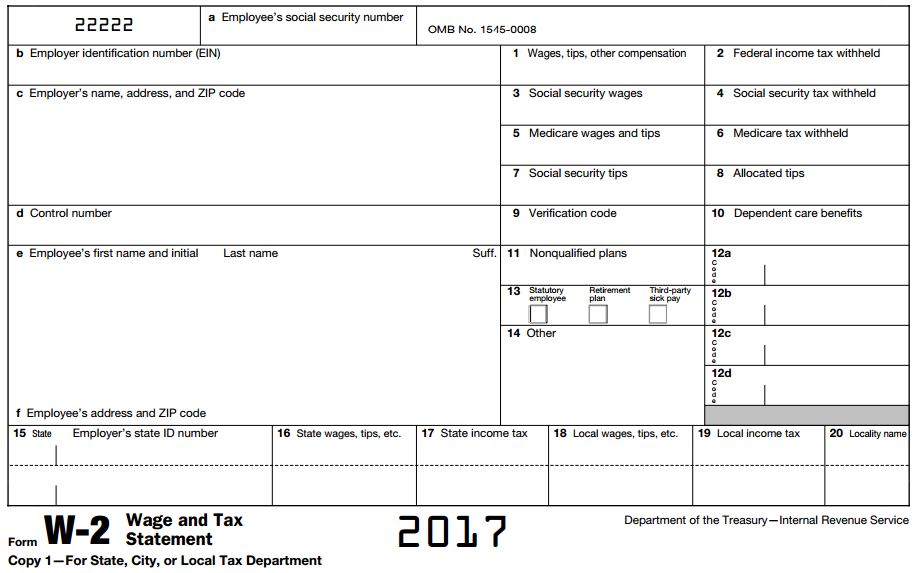

What is W2?

The W2 is the form sent by an employer to the employee and the Internal Revenue Service (IRS) at the end of each year. Sending this form is mandatory in nature, and this reports the annual income and the amount of state taxes that were withheld from the paychecks. Following details are entered on the W2 form.

- Employer Identification number (EIN)

- Employer’s name, address, and Zip code

- Employee’s Social Security Number (SSN)

- Employee’s name, address, and Zip code

- Wages, tips, other compensation and income tax withheld

- Social security wages and social security tax withheld

- Medicare wages, tips, and Medicare tax withheld

Figure 01: W2 form

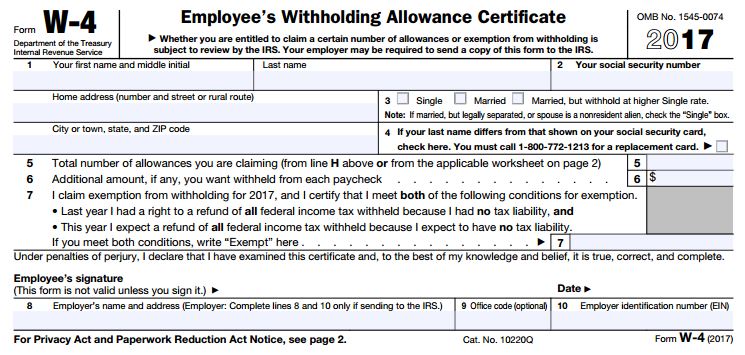

What is W4?

W4 is the form completed by the employee in order to indicate his or her tax situation to the employer. W4 is also referred to as the Employee’s Withholding Allowance Certificate. This form provides information regarding the amount of tax to be withheld from the paycheck of the employee based on the employee’s marital status, the number of exemptions and dependents and other factors to the employer. W4 contains the following information.

- Employee’s name, address, and Zip code

- Employee’s Social Security Number

- Marital status

- Total number of allowances

When the number of allowances is high, the money that the employer withhold for tax purposes will be low. Marriage and dependents also affect an employee’s W4 tax withholdings; thus, all the necessary information has to be updated properly.

Figure 02: Form W4

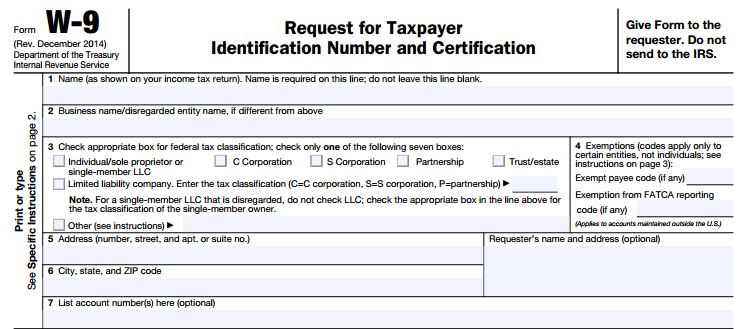

What is W9?

W9 is the form filled by third party companies such as independent contractors who provide services to companies, upon the request from the respective company. The w9 form is also known as the Request for Taxpayer Identification Number and Certification Form. Name/ business name, address, zip code and taxpayer identification information of the taxpayer (this is usually the Social Security Number or the Employer Identification Number) are included in the W9 form as general information. Following such, W9 mainly consists of two parts:

W9 is an IRS form; however, this is not sent to the IRS, but is maintained by the individual who files the information return for verification purposes. W9 also serves as an important identification of the TIN of the taxpayer. Companies who obtain services from third parties can request the W9 from a U.S. citizen or a foreign national.

Figure 03: Form W9

What are the similarities between W2 W4 and W9?

- W2, W4, and W9 are documents prepared for tax purposes.

- Social Security Number is the main identifier included in W2, W4, and W9.

What is the difference between W2 W4 and W9?

W2 vs W4 vs W9 | |

| Definition | |

| W2 | W2 is the form sent by an employer to the employee and the Internal Revenue Service (IRS) at the end of each year. |

| W4 | W4 is the form completed by the employee in order to indicate his or her tax situation to the employer. |

| W9 | W9 is the form filled by third party companies such as independent contractors who provide services to companies, upon the request from the respective company. |

| Availability | |

| W2 | Employer is the responsible party for the completion of the W2. |

| W4 | W4 is a form that has to be completed by the employee. |

| W9 | Independent contractors are entitled to fill the W9. |

Summary- W2 vs W4 vs W9

The difference between W2 W4 and W9 can be mainly identified by giving consideration to the party responsible for completing the respective form. They have to be filled by employers (for W2), employees (for W4) and independent contractors (for W9). Filling these forms are mandatory in nature to ensure proper payment of tax which is a responsibility of the mentioned parties. Further, tax calculation and documentation has been made convenient by these forms.

Download PDF Version of W2 vs W4 vs W9

You can download PDF version of this article and use it for offline purposes as per citation notes. Please download PDF version here Difference Between W2 W4 and W9.

References:

1.”W-2 Form.” Investopedia. N.p., 02 Nov. 2015. Web. Available here. 21 June 2017.

2. “W-4 Form.” Investopedia. N.p., 18 Nov. 2003. Web. Available here. 21 June 2017.

3. Perez, William. “What You Need to Know about Form W-9.” The Balance. N.p., n.d. Web. Available here. 21 June 2017.

Image Courtesy:

1. “Form W-2, 2006″ By Unknown – (Public Domain) via Commons Wikimedia

2. “W4 completo ejemplo” By FrancoNobell – Own work (GFDL) via Commons Wikimedia

3. “Form W-9, 2005″ By Unknown – (Public Domain) via Commons Wikimedia

ncG1vNJzZmivp6x7pbXFn5yrnZ6YsqOx07CcnqZemLyue8OinZ%2Bdopq7pLGMm5ytr5Wau27DkWaYp5xdq8Buw5NmmKecXavAbsOYaA%3D%3D